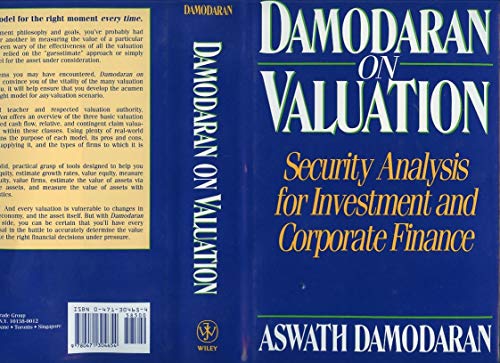

1. Damodaran on Valuation

Authored by Aswath Damodaran, this book is a cornerstone for anyone involved in financial valuation, embedding sophisticated analytical methods. “Damodaran on Valuation” provides an insightful framework for understanding the value of an investment by employing various approaches such as discounted cash flow. This comprehensive guide balances theory with intricate real-world applications, making it an essential resource for finance professionals and students alike. It’s a must-read for those who wish to master the art and science of valuation!

2. The Credit Investor’s Handbook

Michael Gatto’s “The Credit Investor’s Handbook” is indispensable for understanding the intricacies of leveraged loans, high yield bonds, and distressed debt. With its detailed exploration into risk management and analytical techniques, this handbook is especially valuable for investors seeking to navigate complex credit markets. This guide goes beyond the basics, offering unique insights that will sharpen your competitive edge in investment banking and asset management.

3. Investment Banking Workbook: 500+ Problem Solving Exercises

This workbook is a vital tool for aspiring investment bankers, containing an array of over 500 problem-solving exercises and multiple-choice questions. Collins of Rosenbaum, Pearl, and Gasparro designed it as a companion to their famed investment banking resources. This workbook solidifies your understanding and provides practical experience in investment analysis, corporate finance, and financial modeling, ensuring that you are practice-ready for the competitive finance landscape.

4. Corporate Finance Workbook

This engaging workbook by the CFA Institute alongside distinguished professionals is designed to enhance your expertise in corporate finance. It integrates economic foundations with essential financial modeling techniques, making complex concepts more digestible. With illustrative examples, this workbook is perfect for both students and practitioners looking to refine their skills in real-world finance scenarios, allowing them to tackle corporate finance challenges effectively.

5. Investment Banking: Valuation, LBOs, M&A, and IPOs

Rosenbaum and Pearl dive into the core components of investment banking in this comprehensive guide, perfectly tailored for students. Covering valuation techniques, leveraged buyouts (LBOs), mergers and acquisitions (M&As), and initial public offerings (IPOs), this book is an essential resource for understanding market dynamics. Its practical approach enables readers to apply theoretical knowledge directly to impactful decision-making, crucial for any aspiring investment banker.

6. Investment Valuation: Tools and Techniques

Aswath Damodaran once again proves his supremacy in valuation with “Investment Valuation.” This book provides readers with various tools and techniques necessary for determining the value of any asset. Offering practical exercises alongside theoretical foundations, it is ideal for investment analysts, financial consultants, and corporate managers. Understanding these valuation techniques can elevate one’s investment decisions and enhance corporate financial strategies.

7. Alternative Investments: CAIA Level I

An essential guide for alternative investment strategies, this book is aligned with the CAIA curriculum and covers a wide range of asset classes beyond traditional investments. Written by industry experts, it offers insightful analyses and detailed explanations of risk and returns in alternative investments. This resource is perfect for those looking to expand their portfolio and expertise in hedge funds, private equity, and real estate dynamics.

8. Corporate Finance: A Practical Approach

This title serves both as a textbook and a reference guide, offering a practical approach that breaks down complex corporate finance topics into understandable concepts. With contributions from leaders in the field, it provides robust frameworks for financial decision-making, capital markets, and corporate strategy. Essential for both students and professionals, this book equips readers with the tools necessary to thrive in today’s financial environment.

9. Fundamentals of Corporate Finance

The classic text, “Fundamentals of Corporate Finance” by Brealey, Myers, and Marcus is still relevant today. It introduces the foundational principles of finance through real examples and clear explanations, making it accessible to readers at all levels. This book is central for grasping corporate finance’s intricate workings, covering essential topics like capital structure, valuation, and financial planning, all critical for any finance professional.

10. Fundamentals of Finance: Investments, Corporate Finance, and Financial Institutions

Akan and Tevfik’s “Fundamentals of Finance” serves as an introductory yet comprehensive text that explores the key concepts within investments, corporate finance, and financial institutions. It’s well-suited for newcomers to the field who seek a solid foundation and offers practical insights that can enhance financial decision-making. This book is perfect for those new to finance or professionals seeking to diversify their knowledge.