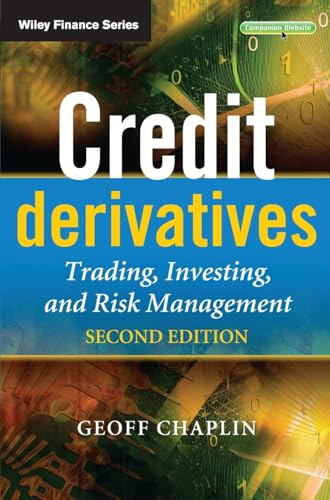

1. Credit Derivatives: Trading, Investing, and Risk Management by Geoff Chaplin

In the complex world of finance, understanding credit derivatives is essential for any professional looking to excel in risk management and investment strategies.

Geoff Chaplin’s book, “Credit Derivatives: Trading, Investing, and Risk Management,” provides in-depth insights into the mechanics of credit derivatives, detailing various investment strategies and risk management techniques that can safeguard your portfolio. The clear explanations and practical examples make it a go-to guide for beginners and seasoned professionals alike, empowering you to navigate the intricacies of trading and investing confidently.

Enhance your understanding of these crucial financial instruments by grabbing your copy on Amazon!

2. Credit Derivatives: A Primer on Credit Risk, Modeling, and Instruments

This foundational text by George Chacko, Anders Sjoman, Hideto Motohashi, and Vincent Dessain serves as an excellent introduction to credit derivatives. Costing only $6.24, it is an affordable yet invaluable resource for anyone looking to grasp the complexities of credit risk.

Focusing on essential concepts, this primer helps readers understand not just the instruments themselves, but also the underlying risks associated with them. It features clear illustrations and practical insights that pair well with theoretical knowledge, making it a must-read for finance students and aspiring professionals.

3. Credit Derivatives: Risk Management, Trading and Investing (The Wiley Finance Series)

Another must-read by **Geoff Chaplin**, “Credit Derivatives: Risk Management, Trading and Investing” delves deeper into the intricate world of credit derivatives. This book distinguishes itself with comprehensive coverage of the subject matter, making it both informative and engaging.

What makes this title stand out is its practical focus, particularly on risk management strategies and how they can be integrated into trading and investing practices. The lively writing style keeps readers engaged while imparting essential information, perfect for finance professionals needing to stay updated on recent developments.

4. The Handbook of Credit Risk Management by Sylvain Bouteille

Sylvain Bouteille’s The Handbook of Credit Risk Management is an essential read for anyone contemplating a career in risk management or investment. Priced at $24.60, it offers a comprehensive overview of the principles and practices of credit risk.

This handbook emphasizes a structured approach to managing credit risk, addressing both theoretical foundations and real-world applicability. Its informative and engaging narrative ensures that readers walk away with a robust understanding of how to strategize and mitigate risk effectively. Perfect for both students and professionals.

5. Derivatives Pricing and Credit Exposure Modelling: Python Prototype of XVA for Practitioners (2.0) by Lilan Li

This innovative work from Lilan Li focuses on the practical application of Python programming in the context of credit derivatives, highlighting credit exposure modeling and derivative pricing. For those in tech-driven finance, this book is a treasure trove of knowledge.

At **$46.45**, it covers advanced topics while maintaining clear explanations suitable for both practitioners and finance students. Li’s fresh perspective on the intersection between programming and finance is sure to illuminate the path toward effective risk management through modern technology.

6. Credit Risk Frontiers by Tomasz Bielecki, Damiano Brigo, and Frederic Patras

A critical examination of the subprime crisis and its impacts, Credit Risk Frontiers is a collaboration of experts who demystify complex concepts such as liquidity and CVA. At $60.00, this serious title addresses pressing contemporary issues in credit risk management and pricing.

With a focus on the reality of market practices, this book is indispensable for professionals dealing with quantitative models and risk assessment tools. Its deep insights provide a roadmap for navigating the ever-evolving landscape of credit risk.

7. Credit Derivatives: Trading & Management of Credit & Default Risk by Satyajit Das

For those keen on understanding the practical aspects of credit derivatives, “Credit Derivatives: Trading & Management of Credit & Default Risk” by Satyajit Das is essential reading. This 1998 publication continues to be relevant in today’s market, especially given its dual focus on trading and management.

By weaving real-world experience into theoretical knowledge, Das provides readers with a well-rounded understanding of how to approach credit risk both strategically and operationally. At $15.19, it’s both a wise investment and a valuable educational tool.

8. Perturbation Methods in Credit Derivatives: Strategies for Efficient Risk Management by Colin Turfus

Colin Turfus’ book focuses on advanced risk management techniques applicable to credit derivatives. Priced at $69.25, this title explores perturbation methods that have been key to the development of strong analytical solutions.

This book is particularly suitable for professionals looking to enhance their strategic approach to credit derivatives. Turfus’ clear explanation, paired with practical examples, makes complex theories easily digestible for practitioners at all levels.

9. Credit Derivatives & Synthetic Structures: A Guide to Instruments and Applications, 2nd Edition by Janet M. Tavakoli

Perfect for those seeking to delve into synthetic structures in credit derivatives, Tavakoli’s comprehensive guide remains a definitive resource in finance. This revised second edition, at $57.73, includes significant updates reflecting the latest trends in derivatives markets.

Tavakoli’s engaging writing style and thorough explanations bring clarity to complex topics, making this book a staple for finance professionals eager to expand their expertise in credit instruments and applications.

10. Modelling Single-name and Multi-name Credit Derivatives by Dominic O’Kane

Dominic O’Kane’s “Modelling Single-name and Multi-name Credit Derivatives” is a must-have for anyone serious about mastering credit derivatives pricing and modeling. For a price of $98.24, this title stands as one of the most comprehensive resources available on the matter.

By addressing both single-name and multi-name credit derivatives, O’Kane provides readers with an all-encompassing understanding of modeling strategies, making it an essential tool for risk managers and financial analysts alike. Dive into this expert-level resource to enhance your practical knowledge!