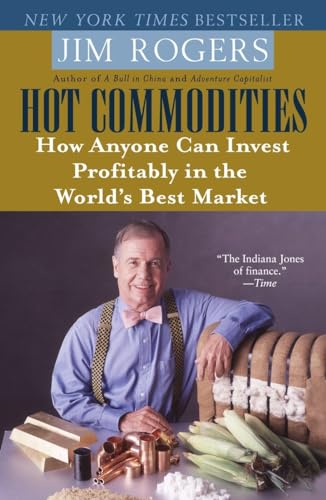

1. Hot Commodities: How Anyone Can Invest Profitably in the World’s Best Market

Written by renowned investor Jim Rogers, this book is a spectacular introduction to the dynamics of commodity investing. Rogers elucidates how commodities serve as both a safe haven during market volatility and a powerful tool for wealth accumulation. The author’s personal anecdotes, coupled with actionable strategies, make it a must-read for anyone looking to diversify their investment portfolio. Whether you’re a seasoned investor or a novice, Rogers provides an engaging narrative that keeps the reader’s attention while delivering crucial information. It’s highly recommended to grasp the fundamentals of investing in commodities for apparent success.

2. Economics of Commodities and Commodity Markets

Authored by Alexander G. Tvalchrelidze, this comprehensive guide dives deep into the economic fundamentals of commodity markets. It discusses critical topics such as pricing mechanisms, market structures, and the regulatory environment, making it indispensable for those who wish to understand the intricate inner workings of commodity economics. Investors, researchers, or students will find this book incredibly insightful as it lays down the economic principles that affect commodity prices globally. The detailed analysis provided serves as both a reference and a fundamental learning tool.

3. Commodity Fundamentals: How To Trade the Precious Metals, Energy, Grain, and Tropical Commodity Markets

Ronald C. Spurga provides a detailed roadmap to understanding and trading various commodity markets in this insightful book. With an emphasis on practical strategies, Spurga outlines the frameworks necessary for effective trading in precious metals, energy, grains, and tropical commodities. The book is laden with data-driven analysis and case studies, making it a practical guide for investors wanting to apply their knowledge. Whether you are new to trading or looking to enhance your skills, this guide is an essential resource.

4. The W. D. Gann Master Commodity Course

W.D. Gann’s esteemed trading course is now more accessible than ever. This book delves into Gann’s unique methods of analyzing price movements and patterns in commodity markets, making it a benchmark for serious traders. The clarity of Gann’s teachings integrates both theory and practical applications, promoting a sophisticated understanding of market fluctuations. His techniques have stood the test of time and are revered by traders across generations for yielding exceptional trading results.

5. Higher Probability Commodity Trading

Carley Garner’s engaging writing style presents advanced strategies for successful commodity trading in this enlightening guide. It emphasizes various market analysis techniques, coupled with a focus on risk management. Garner’s pragmatic approach aims to shift the odds in favor of the trader, equipping readers with the necessary tools to navigate the complex commodity markets with ease. This book is an essential read for those aspiring to elevate their trading skills while minimizing risks.

6. Reflections of an Option Seller: The Rise, Fall, and Return of a Commodity Market Maverick

James Cordier narrates his personal experiences in the commodity markets, sharing key lessons learned from successes and failures. This memoir serves as both a cautionary tale and an inspiring narrative that underscores the importance of resilience in trading. Cordier’s authentic voice resonates throughout the book, connecting with readers and providing valuable insights on option trading strategies, risk management, and the volatile nature of commodities. It’s a compelling read for anyone interested in the harsh realities of trading.

7. Virtual Barrels: Quantitative Trading in the Oil Market

Ilia Bouchouev’s book provides a comprehensive approach to quantitative trading specifically in the oil market. Combining theoretical concepts with practical applications, Bouchouev explains how data-driven decisions can lead to informed trading strategies. This book is perfect for analytical minds looking to harness technology for trading in the volatile oil market. Investors curious about integrating quantitative methods into their trading practice will find this book indispensable.

8. The Energy System: Technology, Economics, Markets, and Policy

Travis Bradford’s in-depth exploration of the energy system is a comprehensive guide that intertwines technology, economics, and policy-making. Understanding the energy landscape is crucial for any investor or industry professional, and this book sheds light on how these elements interact within the marketplace. Bradford effectively combines theory and empirical evidence to present a potent analysis, making it a vital reference for energy traders and investors alike.

9. Back to the Futures: Crashing Dirt Bikes, Chasing Cows, and Unraveling the Mystery of Commodity Futures Markets

Scott Irwin and Doug Peterson provide a fascinating narrative that combines humor and insights into the world of commodity futures markets. It’s more than just educational; it is engagingly written, making complex concepts approachable to casual readers. The authors provide a fresh perspective that’s relatable and entertaining, all while imparting rich knowledge about the functioning of futures markets. Readers will not only learn about commodities but will also enjoy the journey along the way.

10. Commodity Markets: Evolution, Challenges, and Policies

In this essential book, John Baffes and Peter Nagle navigate through the evolution and intricacies of commodity markets. This analytical work highlights the challenges facing commodities today and discusses policies essential for market stability. Investors and policymakers alike will benefit from the authors’ well-researched insights, which cover a wide range of issues from pricing to environmental impacts. This book serves as both a learning guide and a reference for industry professionals seeking to enhance their understanding.