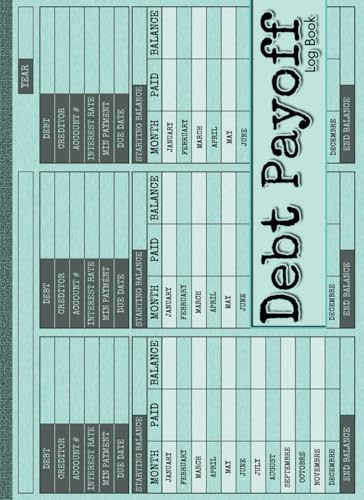

1. Debt Payoff Log Book

Author: Merry Lines

Price: $6.99

Publication Date: November 14, 2024

The “Debt Payoff Log Book” is an essential tool for anyone struggling with multiple debts. This planner not only helps you track your payments but also allows you to visualize your progress toward financial freedom. With 110 beautifully designed pages, it simplifies the daunting process of debt management. Merry Lines expertly provides a structured yet straightforward approach, making it easy to maintain your financial health and achieve your goals. Don’t let debt control your life; take the reins with this indispensable planner.

2. Debt Payoff Planner

Author: Your.Debt.Payoff Publishing

Price: $5.95

Publication Date: April 9, 2022

This simple yet effective “Debt Payoff Planner” provides a clear path to managing your debts through the debt snowball method. The planner is crafted for those who want a clear strategy and straightforward tools to help prioritize and eliminate debts effectively. It’s designed to cater to everyone, from financial novices to experienced budgeters, ensuring you’ll find the guidance you need. With a focus on tracking your progress, this planner acts as both a motivator and a roadmap to financial freedom.

3. Escape Debt Prison

Authors: Larry Faulkner, Lisa Faulkner

Price: $14.95

Publication Date: January 16, 2023

“Escape Debt Prison” provides actionable strategies to liberate yourself from overwhelming debt. Larry and Lisa Faulkner present a comprehensive workbook that not only outlines practical steps for debt reduction but also addresses the emotional challenges associated with financial hardship. This book emphasizes a holistic approach to financial wellness, making it an invaluable resource for anyone feeling trapped by debt. It’s time to break free from the prison of debt and regain control over your financial future!

4. Debt of Honor: A Jack Ryan Novel

Authors: Tom Clancy, John MacDonald

Price: $17.72

Publication Date: January 19, 2011

Though a fictional narrative, “Debt of Honor” expertly weaves themes of political intrigue and personal sacrifice while showcasing the concept of debt in a broader context. Through the lens of Jack Ryan, this novel illustrates the importance of accountability and integrity, reinforcing lessons that resonate beyond mere storytelling. Clancy’s work emphasizes the socio-political dimensions of debt, making it relevant to anyone interested in the deeper implications of financial obligations.

5. Getting Out of Debt For Dummies

Author: Steven Bucci

Price: $15.99

Publication Date: April 30, 2024

For those who feel overwhelmed by their financial obligations, “Getting Out of Debt For Dummies” offers a comforting and straightforward guide. Bucci breaks down complex financial concepts into manageable steps, making it accessible for readers at any level of financial literacy. This edition is particularly helpful for those looking to rebuild their financial health with practical strategies and relatable insights. It’s a must-read for anyone seeking clarity and support on their journey towards financial freedom.

6. Debt Management & Elimination

Author: BarCharts, Inc.

Price: $6.95

Publication Date: December 31, 2013

This concise guide by BarCharts provides quick and practical strategies for those looking to manage and eliminate debt effectively. Ideal for a fast-paced world, it encapsulates vital debt management principles into easy-to-follow steps. The book is perfect for anyone who feels lost in the financial chaos and seeks to gain control over their financial situation without diving into too much detail.

7. Get the Hell Out of Debt

Authors: Erin Skye Kelly

Price: $17.46

Publication Date: July 12, 2021

Erin Skye Kelly’s “Get the Hell Out of Debt” delivers a refreshingly straightforward approach to tackling debt challenges. This three-phase method not only helps you manage your debts but also shifts your mindset towards money, fostering a healthier relationship with finances. This book is suitable for anyone ready to take decisive action and transform their financial landscape. By following Kelly’s advice, readers can unlock the secrets to achieving lasting financial freedom.

8. 7 Steps to Get Out of Debt and Build Wealth

Author: Adeola Omole

Price: $16.19

Publication Date: September 25, 2018

In “7 Steps to Get Out of Debt and Build Wealth,” Adeola Omole offers readers a transformative financial strategy that helped him pay off over $390,000 in debts. This inspiring journey underscores the power of discipline, budgeting, and strategic financial planning. It’s a motivational read that not only provides practical steps to debt elimination but also emphasizes wealth building. This book is a testament to the fact that with the right mindset and tools, anyone can achieve financial success.

9. The Spender’s Guide to Debt-Free Living

Authors: Anna Newell Jones, Carly Robins

Price: $16.53

Publication Date: April 26, 2016

“The Spender’s Guide to Debt-Free Living” is an engaging and heartfelt narrative that chronicles Anna Newell Jones’s journey to financial wisdom through a spending fast. This book highlights how a temporary lifestyle change can spark long-term financial habits. With relatable anecdotes and practical advice, it’s designed for those looking to rethink their relationship with money and cultivate sustainable, debt-free living habits. It serves as meaningful inspiration for anyone willing to embrace change.

10. How Countries Go Broke

Author: Ray Dalio

Price: $24.50

Publication Date: September 2, 2025

In the insightful “How Countries Go Broke,” Ray Dalio explores the principles underlying national debt cycles and their implications for global economies. While this book is targeted at policymakers and economists, it is also relevant for individuals looking to understand the larger economic context of personal debt. Dalio’s analysis can empower readers to make better-informed financial decisions by connecting individual finance management to broader economic principles.