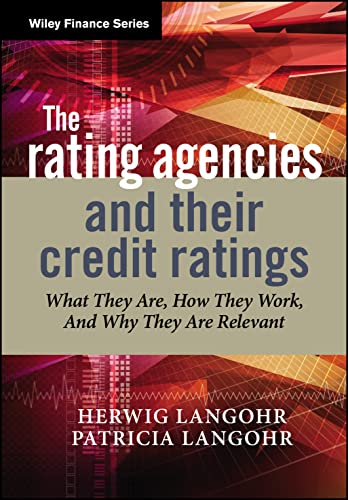

The Rating Agencies and Their Credit Ratings: What They Are, How They Work, and Why They are Relevant

Co-authored by Herwig and Patricia Langohr, this book dives deep into the intricate world of credit rating agencies. As global financial markets continue to evolve, understanding the mechanisms of credit ratings has never been more vital. This book not only elucidates how credit ratings are developed but also critically examines their significance in the modern financial landscape. The authors’ expert insights provide valuable knowledge for investors, finance professionals, and consumers alike. Enhance your credit literacy today!

Credit Intelligence & Modelling: Many Paths through the Forest of Credit Rating and Scoring

Authored by Raymond A. Anderson, this book provides a comprehensive exploration of credit intelligence and modeling techniques. In an age where financial decisions are increasingly data-driven, this book presents multiple approaches to credit rating and scoring, helping readers navigate the complexities of financial analysis. With practical insights and methodologies, it’s a must-read for anyone involved in finance or credit risk management. Unlock new perspectives on credit evaluation!

Credit Rating Agencies (Finance Matters)

Giulia Mennillo uncovers the fundamental roles that credit rating agencies play in the financial ecosystem. This concise yet informative book lays bare the complexities and controversies surrounding credit ratings, making it an essential read for those looking to understand how these ratings influence the global economy. Mennillo’s approachable writing style demystifies the world of finance and is especially beneficial for newcomers to the field.

Rating Politics: Sovereign Credit Ratings and Democratic Choice in Prosperous Developed Countries

This groundbreaking work by Zsófia Barta and Alison Johnston links the spheres of politics and credit ratings in developed democracies. Exploring how political systems affect sovereign ratings and citizen choices, it presents a fresh perspective on governance and finance. This book is crucial for understanding the interplay between economics and political decision-making in our ever-changing geopolitical landscape.

Credit Repair Kit For Dummies (For Dummies (Business & Personal Finance))

Written by Melyssa Barrett, Stephen R. Bucci, and Rod Griffin, this accessible book provides a step-by-step guide to repairing your credit. For anyone struggling with credit issues, this kit is a lifesaver. It’s loaded with practical tips on understanding your credit report, disputing inaccuracies, and improving your score. The friendly “For Dummies” format ensures that you can easily grasp complex concepts, making it perfect for beginners.

A Modern Credit Rating Agency (Routledge Studies in Corporate Governance)

Daniel Cash’s exploration of credit rating agencies within contemporary corporate governance provides an enlightening perspective on the evolution of these entities. This book is a valuable resource for finance professionals looking to stay ahead of the curve. By understanding the current practices and implications of credit ratings, readers can better navigate investment risks and compliance challenges in today’s market.

Rating Based Modeling of Credit Risk: Theory and Application of Migration Matrices

Stefan Trueck and Svetlozar T. Rachev present an advanced discourse on credit risk modeling in this academic treatise. The authors uncover the importance of migration matrices in assessing credit risk and default probabilities. This book is particularly insightful for graduate students or financial analysts seeking a deeper understanding of quantitative financial analysis, making it a standout resource in the field of finance.

How to Remove ALL Negative Items from your Credit Report: Do It Yourself Guide to Dramatically Increase Your Credit Rating

Riki Roash’s DIY guide serves as a practical manual for anyone determined to elevate their credit score. The step-by-step approach to removing negative items from credit reports provides actionable strategies for readers seeking financial freedom. If you’re looking to improve your creditworthiness and regain control over your finances, this is a must-have resource.

The Industry – A History of the Credit Rating Agencies

In this informative account by AM Best and Arthur Snyder III, readers are taken on a historical journey through the evolution of credit rating agencies. Understanding the origins and development of these entities is vital for anyone working in finance today. This book provides context and insight into the current face of credit ratings, making it an essential read for financial professionals and students alike.

Credit Secrets Book + 11 Word Phrase: Raise Your Credit Score, Reduce Debt, Gain Financial Freedom

Written by the Financial Mastery Institute, this unique guide offers innovative insights to raise credit scores and lower debt. The “11-word phrase” is a game-changer for many, promoting a mindset shift that empowers readers to take control of their finances. This book is perfect for those seeking financial literacy and actionable strategies for financial success.