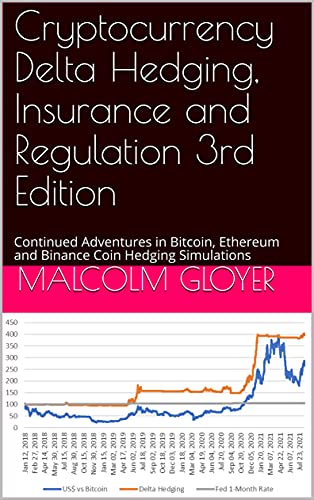

1. Cryptocurrency Delta Hedging, Insurance and Regulation 3rd Edition

Author: Malcolm Gloyer

Are you ready to delve into the intricate world of cryptocurrency hedging? “Cryptocurrency Delta Hedging, Insurance and Regulation” offers a detailed exploration of hedging simulations surrounding Bitcoin, Ethereum, and Binance Coin. This 3rd edition walks readers through advanced strategies that ensure financial security in an unpredictable market. Malcolm Gloyer’s expertise shines as he simplifies complex concepts such as delta hedging and risk management, making this book a vital resource for both novices and seasoned traders.

2. Financial Safety Nets in the Digital Age

Author: Matej Pollick

As the cryptocurrency realm expands, understanding the safety mechanisms in place is paramount. In “Financial Safety Nets in the Digital Age,” Matej Pollick presents a thought-provoking analysis of deposit insurance reimagined for cryptocurrencies and Decentralized Finance (DeFi). This pioneering work tackles contemporary issues surrounding user trust and systemic risk within the crypto ecosystem. Any financial professional or crypto enthusiast will find valuable insights that can shape intelligent investment strategies in an ever-evolving market.

3. The Emerald Handbook of Fintech: Reshaping Finance

Authors: H. Kent Baker, Greg Filbeck, Keith Black

This comprehensive anthology, “The Emerald Handbook of Fintech”, offers invaluable perspectives from multiple contributors in the field. It captures the seismic shifts in financial technology and its implications on traditional finance. With chapters addressing everything from emerging fintech trends to the complex overlays of digital currencies, this handbook not only serves as a thorough reference but also inspires readers to contemplate the future of finance. Perfect for academic and professional reference, this handbook is a heavyweight in the fintech literature.

4. FinTech, Artificial Intelligence and the Law

Authors: Alison Lui, Nicholas Ryder

Venture into the intersection of technology and law with “FinTech, Artificial Intelligence and the Law”. Questo delves into the regulatory frameworks governing modern financial technologies and the ethical implications that arise from AI integration. Through expert analysis, the authors expose the threats and opportunities that the convergence of these industries presents. This book is an essential read for legal professionals, technologists, and anyone interested in understanding the future landscape of finance.

5. Banking and Financial Regulations in India

Author: Naresh Ranga

For readers interested in the regulatory landscape of banking in India, Ranga’s “Banking and Financial Regulations in India” serves as a comprehensive guide. It encompasses critical policies and acts while offering practical insights for legal professionals and banking practitioners. With its exam guides for JAIIB and CAIIB, this book stands out in academic circles. Ranga’s expertise equips readers with the knowledge necessary to navigate India’s complex finance-related regulations, making it a must-have resource.

6. Cryptocurrency Delta Hedging and Derivatives 6th Edition

Author: Malcolm Gloyer

In the latest edition of this insightful series, “Cryptocurrency Delta Hedging and Derivatives” reflects on the dynamic ways to safeguard your investments against market fluctuations. Malcolm Gloyer provides strategies that go beyond mere recommendation, offering a deep dive into advanced hedging techniques essential for managing crypto assets effectively. This sixth edition stands as a testament to the evolving nature of finance, making it essential reading for anyone serious about cryptocurrency investment.