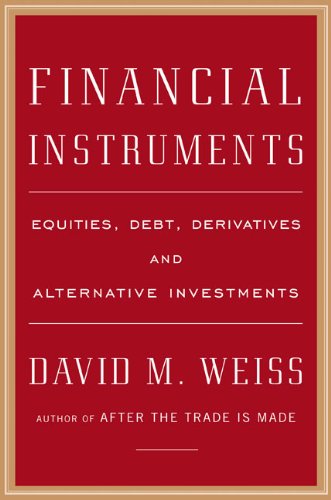

1. Financial Instruments: Equities, Debt, Derivatives, and Alternative Investments

Delve into the world of finance with David M. Weiss’ comprehensive guide, “Financial Instruments: Equities, Debt, Derivatives, and Alternative Investments.” This book is essential for understanding the intricacies of financial markets, providing readers with the foundational knowledge needed to navigate investments successfully. Weiss breaks down complex concepts into digestible sections, making it a valuable resource for both novices and seasoned investors alike. It equips you with the tools to make informed decisions and understand how various investment vehicles work.

2. Debt Cycle Investing: Simple Tools for Reading the Economy to Make Smarter Investment Decisions

Gary Gordon introduces a fresh perspective with “Debt Cycle Investing,” emphasizing the importance of understanding economic cycles for smarter investment decisions. Gordon provides practical tools to recognize patterns in debt cycles, enabling readers to make informed choices that can yield substantial returns. This book is a vital read for anyone looking to refine their investment strategies based on economic indicators, making it a must-have guide for aspirational investors.

3. The Handbook of Corporate Debt Instruments

This extensive resource by Frank J. Fabozzi is a definitive guide to understanding corporate debt instruments. It dives deep into the structures and nuances of various corporate debt products, offering expert insights and analyses. With a wealth of information, this handbook prepares investors to evaluate corporate debt offerings critically, making it an indispensable tool for finance professionals and amateurs alike who seek to specialize in this field.

4. High Yield Debt: An Insider’s Guide to the Marketplace (Wiley Finance)

In “High Yield Debt: An Insider’s Guide to the Marketplace,” Rajay Bagaria and Emil Buchman provide an insider’s look at the lucrative world of high-yield debt investing. This book empowers readers to understand the risks and rewards involved in high yield markets. It is packed with analytical tools and real-world cases that demystify the high yield debt marketplace, making it an essential read for investors looking to maximize returns while managing risk.

5. Leveraged Financial Markets: A Comprehensive Guide to Loans, Bonds, and Other High-Yield Instruments

Charles Maxwell’s “Leveraged Financial Markets” is a comprehensive guide tailored for those looking to explore a variety of high-yield instruments. This well-structured book presents a meticulous analysis of leveraged finance, providing tools to navigate this complex arena. Maxwell’s in-depth explanations, paired with his practical knowledge, ensure readers gain a holistic understanding of how to leverage such financial products for optimal performance. It’s a critical addition for anyone interested in advanced concepts of finance.

6. Collateralized Debt Obligations: Structures and Analysis, 2nd Edition

For those interested in structured finance, Douglas J. Lucas, Laurie S. Goodman, and Frank J. Fabozzi’s “Collateralized Debt Obligations” is an essential resource. This second edition explores the structures, risks, and analysis involved with collateralized debt obligations in detail. It’s incredibly insightful for investors looking to understand these complex instruments’ potential benefits and inherent risks, equipping readers with the analytical tools needed to navigate this challenging area.

7. How Debt Generates Income: A Practical Guide to Leveraging Other People’s Money – Debt Income Systems for Long-Term Wealth

Robert T. offers readers valuable insights in “How Debt Generates Income,” outlining systematic methods to leverage debt to create income and build wealth. This practical guide teaches techniques that empower readers to use debt as a tool rather than a burden. It’s essential reading for anyone looking to understand how to generate income from debt responsibly and effectively, making it a powerful resource for wealth-building strategies.

8. The agency cost of alternative debt instruments

In their work, Antonio Mello and John Parsons explore the agency costs associated with alternative debt instruments. This crucial book sheds light on how different debt instruments can impact agency costs, making it a fundamental read for finance students and practitioners interested in understanding the financial implications of various funding sources. It provides a framework for analyzing these costs and encourages critical thinking about investment decisions.

9. Cash Flow Strategies: Learn to start a business and make money investing in real estate, factoring notes, and other debt instruments.

Trena and Haris Saidi’s “Cash Flow Strategies” is an invaluable resource for anyone looking to start a business or invest in real estate. This guide offers practical techniques for enhancing cash flow through smart investment choices. By providing clear steps for leveraging debt instruments to generate revenue, this book empowers entrepreneurs and investors alike to take charge of their financial futures. It’s a must-read for those interested in cash flow generation strategies.

10. Mastering Private Placement Bank Notes and Credit Instruments

Charles MCKUHN’s “Mastering Private Placement Bank Notes and Credit Instruments” presents an advanced perspective on private placements. This guide walks through the complexities of bank notes and credit instruments, offering readers a sophisticated understanding of their principles and operations. It is particularly beneficial for finance professionals aiming to master alternative investment options, making it an essential addition to any finance library.