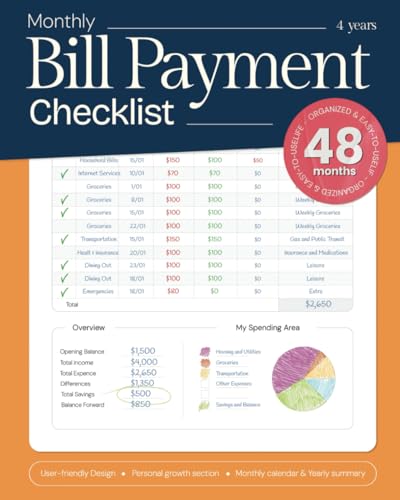

1. Monthly Bill Payment Checklist: Comprehensive Notebook and Organizer for Monthly Bills, Budget Planning, Expense Management, and Debt Tracking

Written by Royce V. Nylera, this comprehensive notebook is more than just a checklist; it is an essential tool for anyone looking to improve their financial management skills. With its user-friendly layout, it offers a structured way to track monthly bills, set budgets, and manage expenses efficiently. Planning your finances doesn’t have to be stressful, and this organizer ensures that you stay on top of essential payments, helping you avoid late fees and keep cash flow in check. As you fill in the pages, you will increasingly feel empowered to take control of your financial future. This is a perfect gift for yourself or a loved one aiming for better financial health.

2. MONEY, INSURANCE & FINANCIAL LITERACY for EVERYONE: Important Ideas, Concepts & Principles SIMPLIFIED (The SIMPLIFIED Series)

This book by Abe J. Garcia is a game-changer for anyone looking to enhance their financial literacy. It breaks down complex financial concepts into easily digestible sections, making the topics accessible for everyone, regardless of their prior knowledge. With clear explanations and practical tips on insurance and personal finance, this book demystifies the often intimidating world of finance. Whether you’re a student or a seasoned professional looking to refresh your knowledge, this book can help give you a solid foundation in managing money wisely. Its simplicity and clarity make it a must-read for anyone eager to understand their financial implications better.

3. Tax Treatment of Single Premium and Other Investment-Oriented Life Insurance

For those delving deep into life insurance implications, understanding the tax treatment is crucial. This book highlights discussions and hearings in Congress from the perspective of financial professionals, providing valuable insights into the interplay between life insurance and tax policies. Although it might seem niche, it is an essential read for policyholders and financial advisors who want to grasp the intricate details of life insurance taxes. It bridges the gap between insurance management and tax obligations, ensuring that readers are informed about every aspect of their policies.

4. The Total Money Makeover Workbook: Classic Edition

Dave Ramsey’s principles of financial management are iconic, and this workbook is the perfect companion for anyone looking to implement his strategies effectively. It features step-by-step plans and exercises that reinforce the teachings of his bestselling book. By engaging with this workbook, readers will find themselves motivated to plan for debt elimination and savings. It encourages you to take actionable steps toward financial security and will resonate with you long after you close the book. Great for both beginners and those who’ve already started their financial journey, it’s a practical tool in achieving a total money makeover.

5. My Life Manager©: A Complete Record Keeper & Workbook

Katrina Mulberry’s innovative approach with this complete record keeper aids in organizing personal information effectively. In today’s fast-paced world, managing life events, emergencies, and opportunities can be overwhelming. This workbook not only helps with organization but also instills a sense of preparedness. By filling it out, users can smooth out coordinates of their life journey while having vital information readily available during critical moments. This makes an excellent gift for anyone who struggles with planning or organization.

6. The Smart Stepfamily Guide to Financial Planning

When blending families, financial management can often get complicated. This insightful book by Ron L. Deal and partners addresses the unique financial challenges faced by stepfamilies. It provides practical solutions and emotional support, making it a must-read for families integrating finances. Readers will appreciate the candid approach and actionable tips provided to prevent financial dilemmas that can arise in blended family situations. Financial harmony is essential in stepfamilies, and this book is an invaluable resource for that endeavor.

7. Am I Going to Be Okay?: Money

Patti Brennan dives into important financial questions we often find ourselves asking. This book is not just about money; it’s a toolkit filled with timely intelligence, actionable ideas, and answers to pressing queries regarding personal finance. Great for readers who may be feeling anxious about their financial situation, it offers relatable advice that can be implemented immediately. The engaging writing style makes it approachable, allowing readers to feel connected and supported on their financial journey.

8. The Wealth Architect: Building a Life of Unstoppable Riches

Authored by Ted Kiyosaki, this book promises to shake up your preconceptions about building wealth. Kiyosaki offers powerful strategies to create a mindset geared towards financial success. The focus is not just on acquiring wealth but rather on building a sustainable life full of riches that go beyond just money—such as experiences, relationships, and knowledge. It’s an eye-opener for anyone looking to revamp their approach to wealth creation. Invest in your future with insights from Kiyosaki’s motivational style and practical guidance.

9. Pay The Fucking Bills: Simple Monthly Bill Organizer

Humorous yet practical, this book by Love Budget provides an engaging way to help you get your financial life in check. Sometimes, the best way to tackle a daunting task like bills is to take a light-hearted approach. It’s straightforward and offers various templates and ideas for organizing monthly bills. This essential organizer helps prevent stress and oversights while tackling your financial obligations with a smile. It’s perfect for those who want to get serious about their budget but appreciate a bit of irreverent humor.

10. Bequeathing Our Debts

This book by the Association of Life Insurance Presidents tackles a sobering subject concerning life insurance policies and debt management. It delves into the implications of inheriting debts and the responsibilities tied to these financial obligations. The insights provided in this book are invaluable for policyholders and beneficiaries alike, highlighting the importance of understanding what you’re leaving behind. It proposes remedies and solutions to mitigate risks and explores the impact of life insurance policies on loved ones. This is critical reading for anyone who wants to ensure their family is well-prepared after their passing.