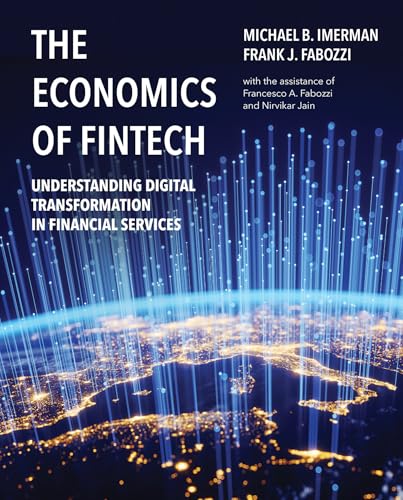

The Economics of FinTech: Understanding Digital Transformation in Financial Services

Written by experts Michael Imerman and Frank J. Fabozzi, “The Economics of FinTech” provides a profound dive into how digital transformation is reshaping financial services. This book is an essential read for anyone intrigued by the intersection of technology and finance. It unfolds the economic implications of FinTech innovations and equips readers with the analytical tools needed to navigate this evolving landscape. Its comprehensive approach will enlighten both novices and seasoned professionals on how to leverage FinTech strategies for success.

Banks and Fintech on Platform Economies: Contextual and Conscious Banking

Paolo Sironi’s work, “Banks and Fintech on Platform Economies,” explores the transformative power of platform economies in the banking sector. This book is particularly relevant in today’s rapidly changing financial world where traditional banks are increasingly challenged by agile FinTech companies. Sironi provides insights into conscious banking methods that harness innovation and foster customer-centric service. This is a must-read for industry professionals looking to adapt and thrive amidst competitive pressures.

Behavioral Assessments of Using Fintech Services and E-Commerce

Authored by Van Duong Ha and Thi Thuy Nguyen, “Behavioral Assessments of Using Fintech Services and E-Commerce” dives deep into consumer behavior in the digital finance landscape. This book combines psychological insights with practical applications, providing a rich understanding of how users interact with FinTech services. It serves as a crucial resource for marketers and designers alike, who aim to create user-friendly digital interfaces that resonate with consumer needs and behaviors.

Behavioral Finance for Private Banking: From the Art of Advice to the Science of Advice

Kremena K. Bachmann, Enrico G. De Giorgi, and Thorsten Hens illuminate the intricacies of client interactions in private banking with their insightful book. “Behavioral Finance for Private Banking” bridges the gap between traditional financial advice and modern behavioral insights, transforming how wealth managers can approach client relationships. This essential guide is tailored for finance professionals who aspire to enhance their advisory strategies through a deeper understanding of client psychology.

Fintech and Green Investment: Transforming Challenges into Opportunities

This collaborative effort by Cuong Nguyen, Khanh Hoang, and Christopher Gan addresses the burgeoning field of sustainable finance through the lens of FinTech. “Fintech and Green Investment” showcases how technology can facilitate significant strides in eco-friendly investments, offering readers actionable frameworks to overcome related challenges. For investors and eco-entrepreneurs, this book serves as a practical guide to harnessing innovation for environmental good.

Behavioral Finance: The Coming of Age

Itzhak Venezia’s “Behavioral Finance: The Coming of Age” presents a thorough exploration of how psychological influences affect financial decisions. This book is pivotal for anyone wanting to understand the underlying behavioral patterns that drive market trends and investor sentiment. Through a mix of research and practical examples, Venezia equips readers with the tools to better analyze financial behavior, making it an invaluable resource for economists and individual investors alike.

Culture Coding: Harness technology, artificial intelligence and behavioural science to empower your business culture and performance

In his groundbreaking book, Chris Davies fuses technology, artificial intelligence, and behavioral science to redefine workplace culture and performance. “Culture Coding” is a must-read for leaders and HR professionals looking to innovate their organizational culture and drive employee engagement. By integrating these modalities, Davies illustrates how businesses can thrive in the digital age, making this book a powerful addition to anyone’s management library.

The Finance-Innovation Nexus: Implications for Socio-Economic Development

William A. Barnett and Bruno S. Sergi’s “The Finance-Innovation Nexus” sheds light on the integral relationship between finance and economic growth. This thought-provoking work challenges readers to consider how innovation in finance can lead to wide-reaching socio-economic development. It is an essential read for policymakers and business leaders who are keen on understanding the greater implications of finance innovations, thus shaping a better future for economies globally.