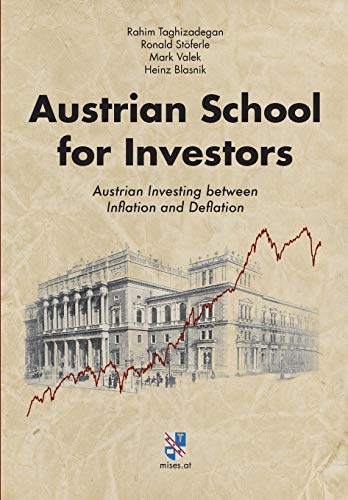

Austrian School for Investors: Austrian Investing Between Inflation and Deflation

In this profound book by Rahim Taghizadegan, readers are introduced to the principles of Austrian economics and its application in modern investment strategies. Taghizadegan expertly navigates the intricate relationship between inflation and deflation, equipping investors with the tools needed to make informed decisions in volatile economic climates. This book is a vital resource for those serious about understanding market dynamics and safeguarding their investments. It encourages readers to think critically and adapt their strategies to thrive amidst economic fluctuations.

Revenue Sourcing: The Retirement Planning Strategy for the Post-Pandemic Economy

In his groundbreaking book, Dennis Tubbergen presents a timely retirement planning strategy designed specifically for the post-pandemic economy. With a focus on proactive financial planning, Tubbergen provides insights into how to maintain and grow wealth during uncertain times. This practical guide is essential for anyone approaching retirement or looking to secure their financial future. Readers will appreciate Tubbergen’s clear strategies and actionable advice, making it a crucial addition to any financial library.

Common Sense Answers to Everyday Questions: Inflation and Deflation

The insights provided by Iustin Rosioara in this book are both enlightening and accessible. Rosioara takes complex economic concepts of inflation and deflation and breaks them down in a straightforward manner, making it easier for readers to grasp these important topics. This book is perfect for anyone who wants to understand how inflation and deflation affect their everyday lives and financial wellbeing. Rosioara’s common sense approach allows readers to apply these principles effectively, making it a must-read for everyone from investors to everyday consumers.

Equity Investment Strategy of Deflation Era (Japanese Import)

This Japanese import presents crucial insights into developing effective equity investment strategies during a deflationary period. Although the book is targeted towards a specific audience, it provides universal lessons on navigating market complexities. Even if you aren’t proficient in Japanese, the strategic principles highlighted transcend language and cultural barriers, making it valuable for anyone looking to adapt their investment approach to changing economic conditions. It’s an essential read for those invested in long-term financial rewards.

The Demographic Cliff: How to Survive and Prosper During the Great Deflation

Harry S. Dent’s book delves into the implications of demographic trends on economic stability, providing a clear analysis of the impending challenges posed by a deflationary economy. Dent’s insights are particularly relevant during times of economic uncertainty, making this book crucial for investors aiming to prepare for potential market downturns. His well-researched predictions also offer actionable advice for profit in adverse conditions. This book is a compelling read that mixes data analysis with strategic investment advice.

To Deflation Exit Strategy from Economic Reform (Japanese Import)

This book confronts pressing issues surrounding economic reform, particularly through the lens of deflation strategy. Although it is labeled as a Japanese import, the concepts discussed within are globally applicable. Readers will find innovative strategies that can be implemented across different economic landscapes to facilitate profitable exits from deflationary periods. This book stands out due to its forward-thinking approach, making it a unique read for those wanting to cultivate resilience in their investment strategies.

SuperCycles: The New Economic Force Transforming Global Markets and Investment Strategy

In “SuperCycles,” Arun Motianey discusses the grand cycles of economic change and their implications for modern investments. This timely analysis reveals how global markets are in continuous flux and emphasizes the need for investors to adapt their strategies accordingly. Motianey’s deep understanding of macroeconomic trends allows readers to foresee shifts that could impact their portfolios profoundly. This book is an eye-opening guide that encourages both novice and seasoned investors to rethink their market approaches and embrace change.

The Equity Premium Puzzle: Intrinsic Growth & Monetary Policy

In “The Equity Premium Puzzle,” Robert Shuler dives into the intersection of intrinsic growth and monetary policy, presenting an unexpected solution for navigating the challenges of a likely jobless age. This book not only unravels the complexities of equity premium but also offers profound strategies for maximizing investment returns amidst changing economic landscapes. Shuler’s thought-provoking insights are critical for any investor, making this book a must-read for individuals aiming to advance their financial knowledge base.

The Age of Deleveraging: Investment Strategies for a Decade of Slow Growth and Deflation

This insightful book delves into investment strategies tailored for a decade characterized by slow growth and deflation. With the author’s unique perspective on economic cycles, readers gain crucial insights into how to secure their finances amidst economic downturns. The strategies outlined are practical and based on well-researched data, providing a solid foundation for making informed financial decisions. It’s an essential piece for investors who seek to thrive in challenging market conditions.

Interest Rate Strategy

John A. Pugsley’s book on interest rate strategy is packed with essential knowledge for anyone looking to navigate the intricate world of finance and investment. Understanding interest rates is crucial for maintaining and growing personal wealth, and Pugsley’s insightful exploration of this topic resembles a roadmap for investors. By dissecting how interest rates affect various investment vehicles, he provides valuable guidance that every investor should heed. The strategic principles introduced in this book empower readers to make informed financial decisions.