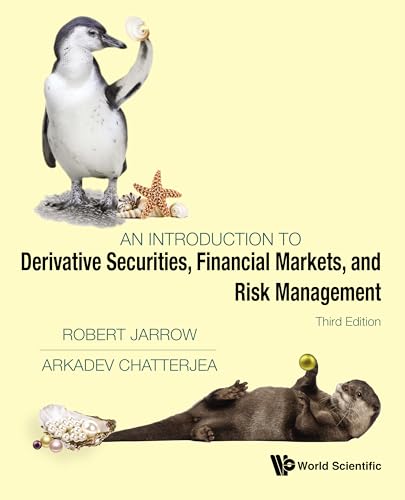

An Introduction to Derivative Securities, Financial Markets, and Risk Management

Written by experts Robert A Jarrow and Arkadev Chatterjea, this book provides a comprehensive overview of derivative securities and their importance in financial markets. It delves into the intricacies of risk management and the fundamental theories that underpin financial practices. A must-read for anyone involved in finance, this work equips readers with the necessary tools to navigate complex financial instruments and manage risks effectively. Whether you are a student or a professional seeking to refine your knowledge, this book is indispensable.

Introduction to Stochastic Finance with Market Examples

Nicolas Privault’s compelling text is an excellent entry point into stochastic finance. It bridges theoretical concepts with real-market examples, making it an ideal choice for those who want to understand finance through the lens of randomness and uncertainty. The structured approach helps readers grasp complex mathematical concepts while providing practical applications. This book is wildly beneficial for analysts and students who must understand models that influence market dynamics.

Mathematics of Financial Markets

Authored by Robert J. Elliott and P. Ekkehard Kopp, this book offers an insightful exploration into how mathematical concepts are applied in financial markets. With rigorous attention to detail, it covers a range of topics essential for understanding the quantitative aspects of finance. This book is not just for mathematicians; it’s for anyone eager to comprehend how mathematics influences market behavior and decision-making. A great resource for both students and seasoned professionals alike!

Lecturing Birds on Flying

Pablo Triana’s provocative book, co-written with Nassim Nicholas Taleb, challenges conventional wisdom in finance by scrutinizing the role of mathematical theories in the downfall of financial institutions. It’s a critical read that underscores the disconnect between mathematics and real-world finance. The authors emphasize the importance of qualitative judgments and the dangers of over-reliance on quantitative models. This book is perfect for readers who appreciate a critical look at the role of theory in market practices.

Stochastic Finance: An Introduction with Market Examples

In this accessible yet profound book, Nicolas Privault introduces readers to stochastic finance using market examples to elucidate complex concepts. The mix of theory and practical examples ensures readers not only understand but also appreciate the real-world implications of stochastic modeling. This book stands out in its ability to clarify the intricacies of financial mathematics, making it an invaluable asset for anyone aspiring to excel in finance.

Financial Mathematics, Derivatives and Structured Products

This collaborative work by Raymond H. Chan, Yves ZY. Guo, Spike T. Lee, and Xun Li presents a thorough examination of financial mathematics, focused on derivatives and structured products. The commentary balances rigorous theory with practical analysis, making it beneficial for both experienced finance professionals and newcomers. This book is crucial for grasping the complexities surrounding derivatives in today’s dynamic financial markets.

Pathwise Estimation and Inference for Diffusion Market Models

Nikolai Dokuchaev and Lin Yee Hin’s book dives deep into the pathwise estimation and inference crucial for understanding diffusion market models. This sophisticated subject is addressed with clarity, making it approachable for readers looking to implement advanced methodologies in finance. The insights provided make this book particularly valuable for financial analysts and researchers focusing on quantitative finance.

Pricing the Future: Finance, Physics, and the 300-year Journey to the Black-Scholes Equation

George G. Szpiro leads readers through the fascinating narrative of the Black-Scholes equation, intertwining finance with physics over a 300-year journey. This historical perspective not only enriches financial literature but also deepens readers’ understanding of how various disciplines intersect in the world of finance. It is both an educational and enjoyable read that will appeal to enthusiasts and professionals alike.

Mathematics of Finance: An Intuitive Introduction

Donald G. Saari’s book offers a unique introduction to the mathematics of finance, designed for a broad audience. It simplifies intricate concepts without sacrificing depth, making it an excellent resource for beginners and advanced readers alike. Providing intuition and insight, this book lays a strong foundation for understanding the mathematical underpinnings of financial models.