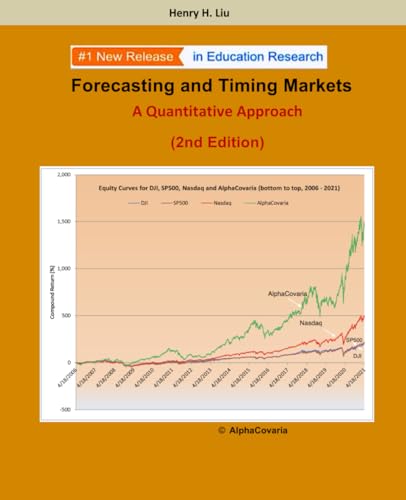

1. Forecasting and Timing Markets: A Quantitative Approach

Henry H. Liu’s “Forecasting and Timing Markets” provides a robust quantitative framework for predicting market movements, making it an essential read for market enthusiasts. This book demystifies the complexities of market forecasting and provides practical tools for trading strategies. Liu’s insights into timing the markets are valuable for both novice and seasoned investors alike. Every chapter is filled with actionable advice that can sharpen your investment acumen. The clarity of explanations, alongside real-world examples, equips readers with the confidence to apply these techniques effectively.

2. Yield Curve Modeling and Forecasting: The Dynamic Nelson-Siegel Approach

Authored by Francis X. Diebold and Glenn D. Rudebusch, this book takes a deep dive into the mechanics of yield curves. Their dynamic Nelson-Siegel approach is necessary for anyone looking to understand interest rate modeling. The authors present intricate yet comprehensible discussions on yield curve phenomena, making it indispensable for economists and financial analysts. Whether you’re analyzing market trends or forecasting economic activity, this book offers an indispensable lens into the interconnectedness of financial instruments.

3. Forecasting Stock Market Trends

In “Forecasting Stock Market Trends,” Kenneth S. Van Strum delivers an engaging and insightful overview of stock market predictions. This book combines theoretical frameworks with practical applications, offering readers a comprehensive toolkit for analyzing market dynamics. Van Strum explains complex trends through a simple narrative that keeps readers engrossed. It is not just a reference book but a guide that empowers readers to make informed investment decisions based on empirical data and historical trends.

4. Stocks, Bonds, Bills and Inflation: Historical Returns

Roger G. Ibbotson and Rex Sinquefield’s classic work reveals crucial insights about historical investments. This book compiles extensive research on long-term returns across various asset classes and serves as an essential resource for understanding how investments react under different economic conditions. It’s more than just historical data; it’s a foundational text for anyone keen on mastering asset allocations, thus fundamentally influencing investment strategies today.

5. Cases in Healthcare Finance, Seventh Edition

George H. Pink and Paula H. Song’s “Cases in Healthcare Finance” incorporates real-life case studies and explores the complexities of managing healthcare costs. The authors offer a blend of theory and practical analysis suitable for finance professionals within the healthcare sector. The insights provided can help you navigate financial ethics and decision-making in a rapidly evolving industry, making it essential for anyone aspiring to work in healthcare finance.

6. Interest Rates and Coupon Bonds in Quantum Finance

Belal E. Baaquie’s remarkable book deals with the often-complex realm of quantum finance. This text presents an innovative approach to understanding interest rates and bond pricing through quantum mechanics. Baaquie’s detailed analysis of coupon bonds is enlightening, making it a must-read for those interested in the intersection of finance and modern physics. This book expands traditional financial theories and introduces readers to new paradigms of thinking.

7. How to Read Nature: Awaken Your Senses to the Outdoors You’ve Never Noticed (Natural Navigation)

Tristan Gooley’s “How to Read Nature” offers an engaging perspective on connecting with the natural world, paving a path that intertwines finance with environmental awareness. While not a traditional finance book, it provides essential lessons on awareness and observation that are crucial for any successful investment strategist. Gooley empowers readers to harness their natural instincts, emphasizing the importance of context in both life and investment decision-making.

8. Bankruptcy, Credit Risk, and High Yield Junk Bonds

Edward I. Altman’s exploration into high-yield bonds delves into the intricacies of credit risk and bankruptcy modeling. This compelling read provides investors with an action plan for navigating the often-treacherous waters of junk bonds. Altman’s methods and models offer clarity amidst volatility, presenting a clear guideline for risk management tailored for the modern market. This book is indispensable for any serious investor looking to understand high-yield investments.

9. Inside the Bond Market: Analyzing Trends and Making Informed Decisions

Robert C. Porter offers keen insights into the bond market with practical analysis techniques. This book is crafted for those seeking to better understand market trends and decision-making processes in the bond arena. Porter’s research equips investors with the tools to navigate market fluctuations skillfully. Each chapter is well-structured, ensuring that readers move from foundational knowledge to advanced techniques seamlessly.

10. A Critique of Dodd-Frank: Forecasting Securitized Mortgage Credit & Default Risk

Benjamin Solomon offers a detailed critique of the Dodd-Frank Act, emphasizing its implications for mortgage credit and default risk. This analytical discourse is invaluable for understanding post-financial crisis regulations and their impact on lending practices. The well-structured arguments highlight the importance of risk forecasting in an era of regulatory changes, making it a must-read for finance professionals seeking to navigate evolving regulations.