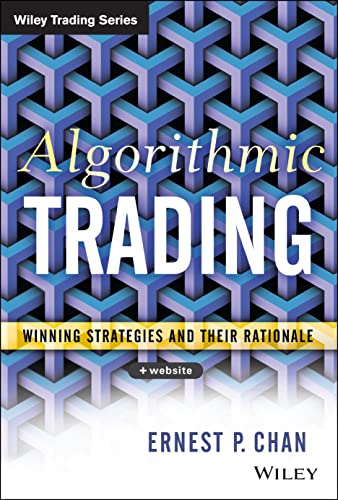

1. Algorithmic Trading: Winning Strategies and Their Rationale

Written by Ernie Chan, this book explores successful trading strategies using algorithms. It’s a comprehensive guide designed for both newcomers and seasoned traders alike. Chan delves into the rationales behind various trading strategies, giving readers a solid understanding of the underlying principles and analysis necessary to succeed in algorithmic trading. The insights offered are applicable across multiple trading platforms, making it an essential read for anyone looking to enhance their trading acumen.

2. ALGO TRADING CHEAT CODES: Techniques For Traders To Quickly And Efficiently Develop Better Algorithmic Trading Systems

Kevin J Davey’s book offers a practical approach for traders eager to streamline their algorithm development process. With the ever-evolving market landscape, the cheat codes provided in this guide are tailored to help automated traders enhance their systems efficiently. This book is not just about theory; it’s a hands-on manual that navigates readers through designing and refining their systems to corresponding market conditions, making it indispensable for modern traders.

3. Algorithmic Trading with Python: Quantitative Methods and Strategy Development

This book by Chris Conlan introduces traders to using Python for quantitative trading strategies. In a world dominated by technology, knowing Python is essential for algorithmic trading. Conlan walks readers through data analysis and strategy development using Python’s powerful libraries, making it a perfect guide for those who wish to integrate programming into their trading strategies. It’s well-structured, with practical examples that enhance the learning experience.

4. Python for Algorithmic Trading: From Idea to Cloud Deployment

Yves J. Hilpisch’s book is a bridge from the conceptual world of trading ideas to actual deployment in the cloud. The book takes a detailed look at the life cycle of algorithmic trading, emphasizing cloud technologies’ role in modern trading. It’s comprehensive and filled with practical applications that show readers how to take their trading strategies from the whiteboard to real profits.

5. Quantitative Trading: How to Build Your Own Algorithmic Trading Business

In this book, Ernest P. Chan provides a detailed framework for designing your own trading systems. He shares essential tips and methodologies for creating sustainable and profitable trading businesses. The author emphasizes understanding market dynamics, proper strategy testing, and risk management principles, making it an invaluable resource for both new and experienced traders looking to refine their strategies.

6. TradeStation EasyLanguage for Algorithmic Trading

Domenico D’Errico introduces traders to TradeStation’s EasyLanguage, illustrating various real-world applications for equities, futures, and Forex markets. This book provides practical insights armed with a solid understanding of technical and fundamental analysis. D’Errico’s clear explanations and actionable strategies make it a must-read for anyone interested in implementing automated trading systems effectively.

7. High-Frequency Trading: A Practical Guide to Algorithmic Strategies and Trading Systems

High-frequency trading expert Irene Aldridge shares her wealth of knowledge in this comprehensive guide. The book covers sophisticated trading strategies and emphasizes the importance of speed in executing trades. Aldridge also discusses the ethical and regulatory frameworks surrounding high-frequency trading, aiding readers in understanding the broader context in which these systems operate. A superb choice for those wanting expert insight into fast-paced trading strategies!

8. Algorithmic Trading and DMA: An introduction to direct access trading strategies

Barry Johnson’s book provides an introduction to direct market access (DMA) trading strategies employed by institutional traders. It combines theoretical concepts with practical advice, aiding traders in navigating the complexities of direct access trading efficiently. Johnson emphasizes mastering the tools necessary for algorithmic trading, ensuring readers are fully equipped to take advantage of available trading technologies.

9. Building Winning Algorithmic Trading Systems

Kevin J. Davey’s follow-up work focuses on the process from data mining to live trading environments. This book provides a deep dive into creating sustainable algorithmic trading systems while offering a website for additional resources. Davey’s journey story inspires and guides readers through the entire timeline of developing successful trading systems.

10. Hands-On AI Trading with Python, QuantConnect, and AWS

This collaborative effort from Jiri Pik, Ernest P. Chan, Jared Broad, Philip Sun, and Vivek Singh offers an innovative look into AI-enhanced trading strategies. It covers using advanced technologies such as cloud computing and machine learning, thus providing a forward-looking perspective on algorithmic trading. It’s vital for anyone aiming to future-proof their trading strategies amidst rapidly evolving market conditions.