Master Your Finances: Essential Journals for Money Management

In an age where financial literacy is paramount, keeping track of our finances can be overwhelming. Thankfully, a range of notebooks and logs are available to help streamline this process. Here are our top picks to enhance your budgeting skills and effective money management.

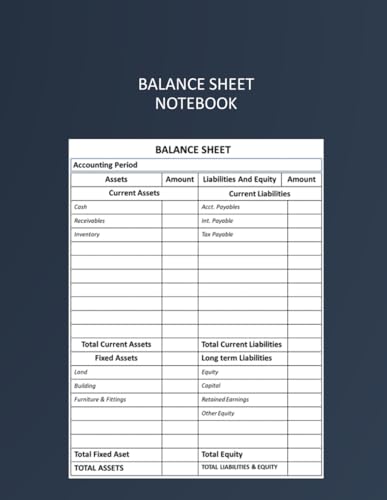

1. Balance Sheet Notebook

The Balance Sheet Notebook by Roy Darling is a versatile tool that aids with income statements, payments, and overall financial management. This journal is designed to help you keep tabs on your financial activities with ease. Its clean layout encourages regular usage, allowing you to develop a habit of monitoring your finances daily. Perfect for individuals or small businesses, it simplifies the complex world of accounting into manageable sections that anyone can understand. Investing just $8.50, this book facilitates a proactive approach to money management.

2. Client Payment Log Book

The Client Payment Log Book by Awakened Dragonfly is a gem for freelancers and service providers. Priced at $6.79, it helps track important client details such as payment amounts and balance due, ensuring you never lose track of your earnings. The structured format allows quick entries, and the design makes it easy to maintain order in your financial dealings, allowing for a seamless flow of information and improved client relationships.

3. Personal Checking Account Balance Register

Journals from Signature Planner have hit the mark with their Personal Checking Account Balance Register. For just $6.99, this helper keeps you aware of all cash inflows and outflows. Studies show that actively tracking your spending can lead to smarter financial choices. Keep your financial life structured and orderly with this easy-to-use tracker that serves as a physical reminder of your financial goals.

4. Checkbook Balance Logbook

The Checkbook Balance Logbook, also from Signature Planner, offers a robust yet straightforward means to manage your checking account. This 6-column ledger helps you keep a detailed record of your payment records, enhancing your understanding of your finances. At $6.99, this logbook makes it easy to manage cash going in and out, ensuring you have a complete picture of your finances at any given time.

5. Monthly Bill Payment Tracker

If you’re struggling to manage your bills, the Monthly Bill Payment Tracker by HENMORO, priced at $7.99, is the ultimate solution. Transforming your monthly bill management into a streamlined process, this tracker provides 84 months of records for maximum savings. It emphasizes goal-setting for your finances and encourages accountability as you monitor due dates and payments.

6. Petty Cash Log Book

The Petty Cash Log Book, authored by JK Roberts and priced at $5.99, is a practical notebook for those who frequently use cash for transactions. By tracking cash in, cash out, date, and descriptions, this log book ensures that you maintain control over your petty cash, reducing misunderstandings and helping you stick to your budget.

7. Monthly Bill Payment Checklist Logbook

Lastly, the Monthly Bill Payment Checklist Logbook is an extraordinary resource for tracking payments over 10 years. For $5.99, this tool offers a structured approach to manage your financial commitments while keeping your records organized. Say goodbye to missed payments and enjoy financial success with ease!

These financial journals are essential for anyone looking to improve their accountability when it comes to money management. By investing in these tools, you can pave the way toward a more organized, financially savvy life.